Smart glasses – niche or mass trend?

A study by The Vision Council provides answers

Smart glasses are becoming increasingly well known, yet are often classified as a niche product. But is that really true? What percentage of people are interested in this new smart product, and where are smart glasses actually being purchased? A detailed US study provides exciting answers to the latest questions about the smart glasses market. An interview with Alysse Henkel.

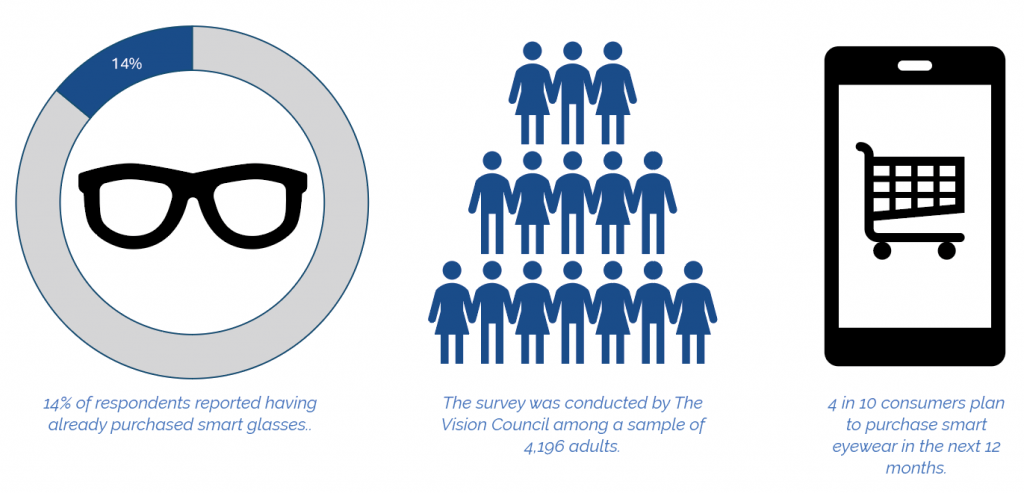

The study was conducted by The Vision Council in August 2025 among 4,196 adults in the US. The results were also compared with the responses from a previous study conducted in 2023. And this much can be said in advance: interest has increased significantly since then.

Alysse Henkel is Vice President of Research & inSights at The Vision Council and provides answers to important questions.

MAFO: How do you define smart glasses in your study?

Henkel: In our study, smart eyewear refers to connected eyeglasses with built-in wireless features. These may include call handling, music playback, messaging, voice assistants, photo and video capture, access to artificial intelligence (AI), real-time translation and transcription, navigation and location services, gesture or touch-based controls, and notification alerts.

MAFO: Smart glasses are often considered a niche product. Do your study results confirm this assumption?

Henkel: Smart eyewear remains a niche category, with only 14% of U.S. consumers reporting past purchases. Though still niche, our study found that interest and awareness is growing among U.S. consumers. 42% of U.S. consumers report that they plan to purchase a pair of smart eyewear in the next year.

MAFO: Are there certain features or application scenarios that consumers find particularly attractive?

Henkel: While the study did not examine detailed use-cases, the main drivers of interest are curiosity (41%), perceived usefulness (39%), and the product’s fun or novelty factor (37%).

MAFO: What reservations do consumers most frequently express about smart glasses?

Henkel: Consumers who are unlikely to buy smart eyewear most often cite not needing smart eyewear (50%) and the price (41%).

MAFO: In your opinion, what technological or social developments could further increase acceptance in the future?

Henkel: Ensuring that the glasses fit people well and are comfortable to wear is paramount, since 94% of consumers said that fit and comfort were important part of purchase consideration, along with durability and battery life.

Smart eyewear has hardware built into the frames, so the frames tend to be heavier and less adaptable than typical eyewear. Slimming down the tech, while continuing to improve upon existing durability and battery life, may make a purchase more appealing in the future.

MAFO: TVC already conducted a study on smart glasses among US consumers in 2023. How has the level of awareness developed since then?

Henkel: Consumer awareness about smart eyewear has doubled in the last two years. The share of those who know exactly what smart eyewear is has increased by 7 percentage points, and those who have a general sense of what smart eyewear is has increased by 22 percentage points compared to 2023.

MAFO: What factors explain the higher level of awareness today?

Henkel: Increased marketing activity from major brands and social media mentions are likely drivers. This year, 44% of consumers said they had seen, read, or heard about smart eyewear in the last year, up from 23% in 2023. In particular, TV advertising grew 12 percentage points – 24% of consumers told us they had heard about smart eyewear in TV ads in 2023 and 36% said the same in 2025.

MAFO: Which products are best known among consumers?

Henkel: The top three most recognized brands are Ray-Ban Meta AI Glasses, Amazon Echo Frames and Oakley Meta AI Glasses.

MAFO: Where do most consumers come into contact with information about smart glasses?

Henkel: The top sources are YouTube (49%), Facebook (41%), TikTok (37%), Instagram (36%), and TV advertising (36%).

MAFO: What picture does the study paint of the distribution channels for smart glasses?

Henkel: Consumers favor brick-and-mortar consumer electronic stores (54%) and online retailers (48%) as their preferred purchase channels.

MAFO: Were there any results that particularly surprised you?

Henkel: Yes, the 14% adoption rate stood out. Even though smart eyewear remains a niche category, that level of uptake is surprisingly high for a relatively new product.

MAFO: What opportunities and risks do you see for companies investing in this market?

Henkel: The smart eyewear category is entering a period of strong momentum. Early adopters and major industry players have already established the technology as a viable and desirable concept, which means the hardest part of proving consumer relevance has largely been done. Recent successful product launches have sparked significant consumer interest, creating an opportunity for new entrants to build on that rising awareness rather than starting from scratch.

Eyewear serves as both an accessory and an essential function for most people, and consumers have high expectations for comfort, fit, and style. Meeting those expectations while integrating advanced technology remains a technical and design challenge. Companies that cannot balance both may struggle to gain traction.

MAFO: Thank you for the interview.